KRIPTON L-PESA MICROFINANCE SMART CONTRACT

KRIPTON L-PESA MICROFINANCE SMART CONTRACT

L-Pesa Microfinance is a Fintech startup ready to take advantage of the growing need for financial services in the developing world. L-Pesa has a strong focus on automation. 95% of the process of subscribing to loans and acquiring users is automatic and, therefore, extremely scalable. The company has devoted two years to the development of its

customer service and administrative systems with a team of seven software developers. The user experience is based on mobile and web interfaces, and marketing is carried out mainly through social networks and SMS.

customer service and administrative systems with a team of seven software developers. The user experience is based on mobile and web interfaces, and marketing is carried out mainly through social networks and SMS.

The technology of L-Pesa is based on Amazon Web Services, an extremely scalable cloud computing platform that has been or is used by major brands such as Netflix, Airbnb, Pinterest and Spotify. L-Pesa has integrated a series of third-party applications to perform tasks such as SMS messages, user verification and marketing. Fund transfers are managed through integrations with mobile money service providers such as M-Pesa, Airtel Money, Tigo Pesa and MTN.

Network effect:

L-Pesa is not a charity. L-Pesa is purely a business. Being a business gives us certain freedoms that charities do not have. As a company we have to provide a return. By facilitating microfinance, we must be extremely efficient; the cost of

making a loan of $ 1000 is the same as $ 100, and due to operating costs, banks and financial institutions are limited in how low they can go. Blockchain provides transparency and efficiency, and drastically reduces operating costs, making small loans viable. Tokens are transactionally efficient, making them more attractive to the

L-Pesa target market, and they also help build a community and create a network effect.

We have been doing it with Fiat as an existing operation; blockchain will allow us to expand our reach and reduce our costs. The Bank's financing costs do not allow us to reach the people who are below and who need it the most. The expansion of the operation by virtue of the expansion of the scope would now allow us to make facilities available to people who can not be served by banks or microlenders because they have been considered "unprofitable".

L-Pesa is not a charity. L-Pesa is purely a business. Being a business gives us certain freedoms that charities do not have. As a company we have to provide a return. By facilitating microfinance, we must be extremely efficient; the cost of

making a loan of $ 1000 is the same as $ 100, and due to operating costs, banks and financial institutions are limited in how low they can go. Blockchain provides transparency and efficiency, and drastically reduces operating costs, making small loans viable. Tokens are transactionally efficient, making them more attractive to the

L-Pesa target market, and they also help build a community and create a network effect.

We have been doing it with Fiat as an existing operation; blockchain will allow us to expand our reach and reduce our costs. The Bank's financing costs do not allow us to reach the people who are below and who need it the most. The expansion of the operation by virtue of the expansion of the scope would now allow us to make facilities available to people who can not be served by banks or microlenders because they have been considered "unprofitable".

L-Pesa was founded with the vision of improving the lives of people through efficient access to credit and related financial services. Ron Ezra Tuval, the founder of L-Pesa, has spent most of his career working in developing countries and recognized a decade ago that the most effective way to improve people's lives is through access to credit and services. related financial Since the founding of L-Pesa, Ron has focused singularly on achieving this vision. It's about making the world a better place for everyone. L-Pesa started offering microfinance services in Tanzania in 2016 and has increased its service offerings and its geographic footprint at an increasing rate in pursuit of this vision.

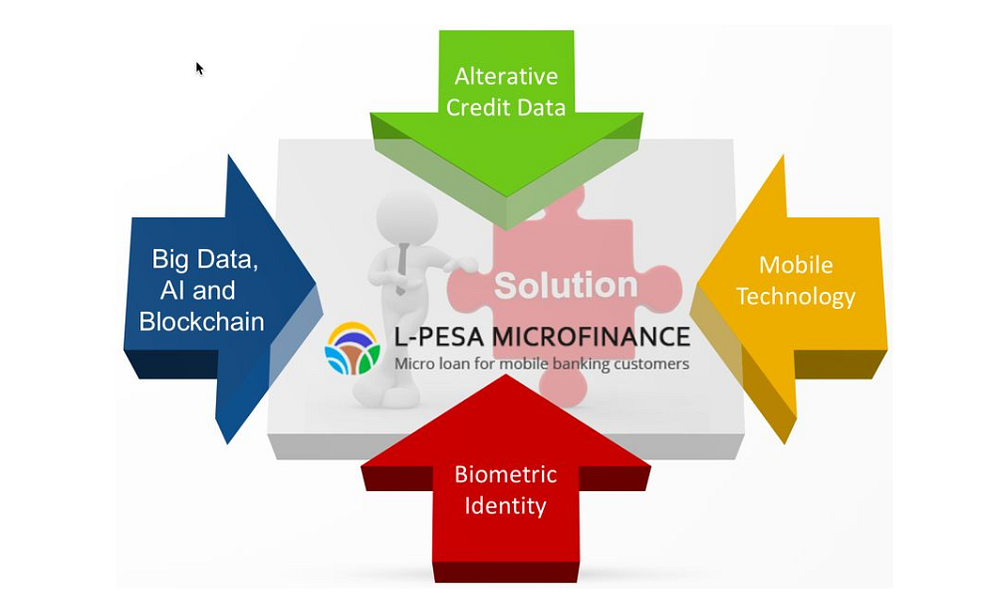

The L-Pesa Initiative

The idea of L-Pesa was incubated for a decade, and the business was

launched at the time when four important market forces converged to allow for

rapid scaling.

launched at the time when four important market forces converged to allow for

rapid scaling.

L-Pesa has built a patented credit subscription system that is one of the keys to its success. Consumer credit reports, as available in Western Europe and North America, do not exist in Africa, India or other developing regions. Several models have been tested over the years, some more successful than others. The L-Pesa model is based in part on a trust ladder: users start with very small loans (usually $ 1.00) and are granted larger loans after the smaller loans have been repaid Successfully as scheduled. Successful payment contributes to a credit score. The credit score is also affected by other factors, such as the completion of identity verification. Further, L-Pesa depends on other service providers to detect users; in their current markets,

For more information visit:

- Website: https://kriptonofafrica.com/

- Telegram: https://t.me/LpesaICO

- Twitter: https://twitter.com/lpesaico

- Facebook: https://www.facebook.com/lpesaico

AUTHOR: Vionaa

My Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=1663173

Komentar

Posting Komentar