VERNAM - TRANSFORMING INSURANCE

VERNAM - TRANSFORMING INSURANCE

Introduction

It is always said that life is always unpredictable. You can never know what, when or how something would happen. Incidents may be positive, or negative, and you have to be always prepared for what life throws in your path. True, we can't avoid any mishaps in our life, but we can be well prepared for the consequences. Insurance is a traditional, yet the best way to ensure that things still go on even in case of any unfortunate incidents. How do you choose the best plan? How do you eliminate unnecessary additional costs? How do you ensure that your data is never tampered with, or your claim is never rejected?

The challenge

The primary challenge that the Vernam platform tries to solve is the additional costs incurred by a customer due to the hefty commissions that the middlemen levy for each policy they market. Most policy terms do not dictate the exact terms of how much of the amount paid by the customer goes as a commission to the broker. This is not a transparent system, and hence the confidence of a customer on the advice and guidance given by a broker might gradually decrease and this may affect the company as a whole.

Second is the storage of data, which is centralised meaning that the complete authority of the data resides with the insurance company. To ensure minimum number of rejected claims, the data should be stored in a public, yet an un-editable manner.

Vernam - Breaking conventional insurance methods

Vernam is a marketplace for insurance policies that is built primarily upon the blockchain technology. This is a platform that aims to provide insurance services to the public by reducing the additional costs that are incurred due to the presence of middlemen and brokers. The brokers or agents usually are paid 20% - 30% of the premium as a commission, most of the time for doing repetitive work. This cost is taken up by the customer itself, and Vernam tries to break this chain.

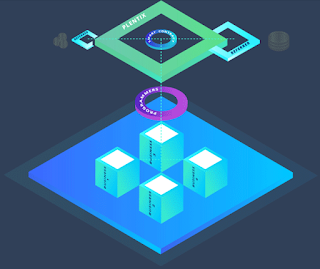

Vernam makes use of the blockchain technology, to maintain a decentralised public ledger which contains the information of its users, their policies, and other details. This ensures that there is no one authority that has complete control over the data, and also since the ledger always self-validates itself, the data present in the ledger is credible and cannot be damaged and altered. Also the personal data of various customers are stored after hashing, so that the privacy and security of the clients are maintained.

By offering policies and services directly to its users, Vernam eliminates the presence of brokers and middlemen, thus reducing the additional commission that has to be paid to them. Instead, this commission goes to the customer itself, as rewards in the form of Vernam Tokens, which can be used inside the platform for renewals, payments, and also purchasing CryptoSafe (CS), the insurance product exclusive to Vernam. Moreover, the elimination of middlemen and reduction of the costs increases the confidence a customer has on the platform and the insurance provider, and thus builds their relationship further.

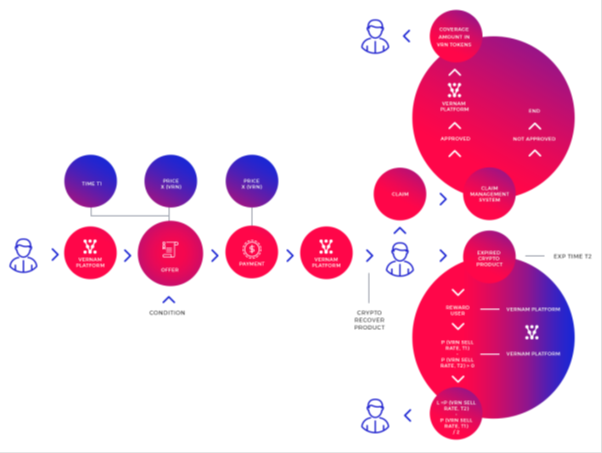

CryptoSafe

CryptoSafe is the digital crypto product of the Vernam platform, and is basically a smart contract that guarantees the client with a compensation in the form of VRN tokens, when a set of defined events occur. Since CryptoSafe is a smart contract, the whole process of buying to claiming and receiving the claim is automated and is fool proof. The smart contract has an expiry period and upon reaching expiry, a pre-defined percentage of the premium is returned back to the client.

Vernam Token (VRN)

The Vernam token is an ERC20 compliant token and is used to make transactions within the Vernam network. Whenever a client requests a new policy, the monetary details are shown in terms of VRN. When the client proceeds with the transaction, the corresponding number of VRN is deducted from his/her wallet, or is redirected to an exchange for the purchase for required number of VRN. Also the rewards are paid in VRN.

Token Sale details

The token sale is scheduled to start on 8th May 2018, till 18th June 2018. The price of the token varies according to the stage of the token sale. During the first stage, which is the first three hours of sale, the tokens are available at 40% discount, at $0.051. After day 1, the token price becomes $0.068, after a discount of 20%. From day 2 to day 7, the price after 10% discount is $0.077. After that the price is $0.085 per token and investors can get 15% discount if their transaction amount is greater than 15ETH.

Conclusion

Vernam is a well-researched, strong concept that can transform the insurance industry forever. The reduction of cost through elimination of broker interaction is a very debatable idea, because this could mean the weakening of those who work for the marketing sector of the insurance industry. This may, gradually, lead to the decline of a job title entirely, and it is advisable that the strategies are modelled so that every person involved in the current system is beneficial from this disruptive idea.

- Website – https://www.vernam.com/

- Whitepaper –https://www.vernam.com/assets/uploads/Whitepaper_Beta_v015.pdf

AUTHOR: Vionaa

My Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=1663173

Komentar

Posting Komentar