Check APO. Decentralized platform for crypto currency derivatives.

Check APO. Decentralized platform for crypto currency derivatives.

Benefits

Transparency

All trades are made through intelligent contracts that guarantee payments to all winners and ensure pool monitoring.

Transparency

All trades are made through intelligent contracts that guarantee payments to all winners and ensure pool monitoring.

Guarantees

The APO platform does not require the participation of option sellers - buyers pay the option directly to the pool and eliminate the risk of unfulfilled obligations.

The APO platform does not require the participation of option sellers - buyers pay the option directly to the pool and eliminate the risk of unfulfilled obligations.

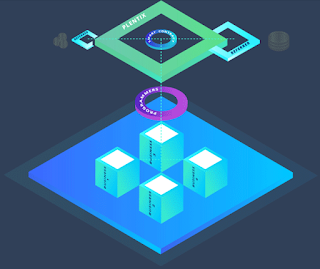

Decentralization

The system being developed is based on clever contracts in the department, which stores all the information about transactions.

The system being developed is based on clever contracts in the department, which stores all the information about transactions.

Dividends

The Platform does not participate in the trade as an organizer but requires a fee for its provision, part of which is distributed among the owners of the Trademarks.

The Platform does not participate in the trade as an organizer but requires a fee for its provision, part of which is distributed among the owners of the Trademarks.

Insurance

The APO lacks guarantee fees - an ideal tool for both miners and investors to protect against a falling market.

The APO lacks guarantee fees - an ideal tool for both miners and investors to protect against a falling market.

Flexibility

Each participant can create their own option - from binary to exotic (at their discretion) or standard use.

Each participant can create their own option - from binary to exotic (at their discretion) or standard use.

Spreads

on the APO platform there is no spread between supply and demand, because there is no vendor that can raise the price in order to reduce risks.

on the APO platform there is no spread between supply and demand, because there is no vendor that can raise the price in order to reduce risks.

How it works

Auction

The auction date is set one week before expiration. The frequency and duration of the auctions will be determined during the beta test.

The platform plans to use standard expiration dates for options:

Auction

The auction date is set one week before expiration. The frequency and duration of the auctions will be determined during the beta test.

The platform plans to use standard expiration dates for options:

2 weeks

1 month

3 months

On this basis, the frequency of the auctions depends on the next contract expiration.

The main objective of the auction is to calculate bonuses and payments based on confirmed applications. Each participant creates the desired option or selects the desired one from the templates and introduces the exercise price for a specific currency (BTC or ETH). Thereafter, the participant selects the type of order market or limit and transfers the amount of money necessary to buy the option on the account of a smart contract.

1 month

3 months

On this basis, the frequency of the auctions depends on the next contract expiration.

The main objective of the auction is to calculate bonuses and payments based on confirmed applications. Each participant creates the desired option or selects the desired one from the templates and introduces the exercise price for a specific currency (BTC or ETH). Thereafter, the participant selects the type of order market or limit and transfers the amount of money necessary to buy the option on the account of a smart contract.

Bid

The pool is formed when the auction is over and all claims are counted. After the transaction, each participant can log in to their account through a website or mobile application, view the accumulated options, and track their pricing until expiration.

The pool is formed when the auction is over and all claims are counted. After the transaction, each participant can log in to their account through a website or mobile application, view the accumulated options, and track their pricing until expiration.

Expiration

The option execution date is formed in advance at the auction, for example, on 12 January 2018 at 12 noon. At the time of expiration, the price of the asset is fixed (the price is determined by data from several major stock exchanges). On the basis of this price, payments are made to the owners of options. After expiry, each participant can check their account.

The option execution date is formed in advance at the auction, for example, on 12 January 2018 at 12 noon. At the time of expiration, the price of the asset is fixed (the price is determined by data from several major stock exchanges). On the basis of this price, payments are made to the owners of options. After expiry, each participant can check their account.

ICO Details

Token Name APO

Token Type ERC20

ICO starts on April 25, 2018 at 10:00 UTC

ICO ends on May 23, 2018 at 09:59:59 UTC

Soft Cap 5,500 ETH

Hard Cap 12,700 ETH

Token Rate 1 ETH = 15,000 APO

Min Transaction amount 0.1 ETH

Bounty Yes

Token Name APO

Token Type ERC20

ICO starts on April 25, 2018 at 10:00 UTC

ICO ends on May 23, 2018 at 09:59:59 UTC

Soft Cap 5,500 ETH

Hard Cap 12,700 ETH

Token Rate 1 ETH = 15,000 APO

Min Transaction amount 0.1 ETH

Bounty Yes

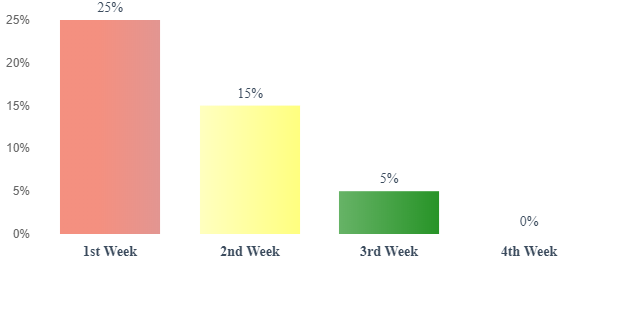

Discount for contributors

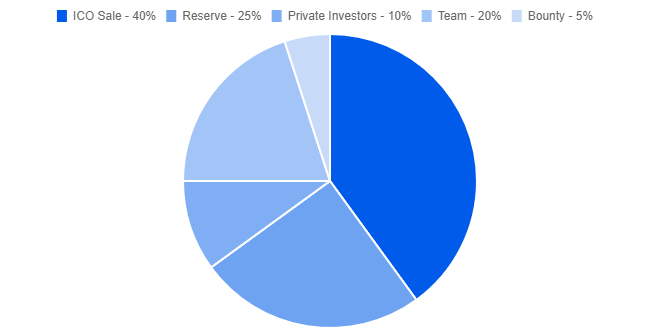

token distribution

roadmap

- Quarter of 2017

Development of a platform for the acquisition of investments

- Quarter 2018

Development of an auction

platform 4rh quarter 2018

platform 4rh quarter 2018

Release of the system

- Quarter 2019

Develop a system for trading options and selling designer options

- Quarter 2019

Release of Option Marketplace Theoretical development of the idea

- Quarter 2018

First phase of the ICO

- Quarter 2018

Beginning of the beta test

- Quarter 2019

Improvement and optimization

- Quarter 2019

Beginning of the beta test Option Marketplace

- Quarter 2019

For more information, please visit:

- WEBSITE: https://apofinance.io/

- TELEGRAM Channel: https://t.me/apofinance

- TELEGRAM group: https://t.me/apofinancegroup

- MEDIUM: https://medium.com/@apofinance

- ANN: https : //bitcointalk.org/index.php topic = 3207939.0?

AUTHOR: Vionaa

My Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=1663173

Komentar

Posting Komentar